Rate Earned on Common Stockholders Equity Formula

Compute issuance stock effect. Rate of return on common stock equity 360 000 72 000 2 550 000 2 400 000 2 100 textRate of return on common stock equity frac 360000text - text 72000left frac 2550000text text 24000002 right times 100 Rate of return on common stock equity 2 2 5 5 0 0 0 0 2 4 0 0 0 0 0 3 6 0 0 0 0 7 2.

Return On Equity Roe Formula Examples And Guide To Roe

Rate earned formula calculate rate earned.

. Determined by dividing net income for the past 12 months by common stockholder equity adjusted for stock splits. Apr 12 2008 0723 PM. Return on equity redirected from Rate Earned on Stockholders Equity Return on equity ROE Indicator of profitability.

Long term loan rs 100000. Assume that the current market price per share of common stock is 27. L 1 Net income - Preferred dividends Average common stockholders equity.

Well the second formula is income - preferred dividends common stockholders equity not common stock. Balance sheet stock expected rate. Rate earned on common stockholdersequity.

A company had net income of 400000 net sales of 10000000 paid dividends of 150000 to the common stockholders and paid dividends of 50000 to preferred stockholders. Net Income After-tax earnings of the company for period t Average Common Equity Common Equity at t-1 Common Equity at t 2 As discussed above the ratio can be used to assess future dividends and managements use of common equity capital. Rate earned on common stockholdersequity.

However it is not a perfect measure since a high ROCE can be misleading. The rate earned on shareholders equity is equivalent to the net profit of the company divided by the equity of its owners and is calculated as a percentage. Common stock 10 par 600000 600000 Paid-in capital in excess of parcommon stock 60000 60000 Retained earnings 330000 210000 If net income is 158100 and interest expense is 30000 for Year 2 what is the rate earned on stockholders equity for Year 2.

The common stockholders have more that their stock account. Rate of return on common stockholders equity h. Higher high level of earnings allocated for each share of outstanding common stock earnings per share ratio formula net income - preferred dividends number.

One Comment on Return on common stockholders equity ratio calculator. Rate earned on common stockholders equity. The formula of Rate earned for total assets is.

That percentage means that Home Depot generated 068 of profit for every 1 that management had. Rate earned on total assets Earnings before interest and tax Average total assets textRatetextearnedtextontexttotaltextassets fractextEarnings before interest and taxtextAveragetexttotal assets Rate earned on total assets. ROE frac text Net Income text Shareholder Equity ROE Shareholder.

Return On Equity ROE Formula and Calculation of Return on Equity ROE The basic formula for calculating ROE is. Result is shown as a percentage. Notice the formula is the rate earned on common stockholder equity.

Profit is shared in the form of Dividend to Shareholders. Rate earned on stockholders equity c. Most of the time ROE is computed for common shareholders.

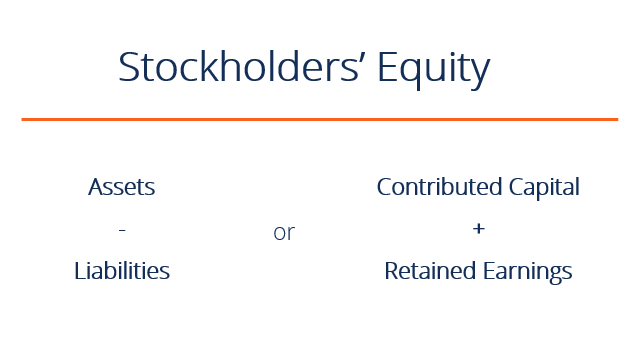

Round percentage to one decimal point a. This is a measure of how well the company is investing the money invested in it. Stockholders Equity represents the Companys financial health.

Investors use ROE as a measure of how a company is using its money. Ratio of fixed assets to long-term liabilities. It equals net income minus preferred dividends divided by average common stockholders equity.

The rate earned on stockholders equity is equal to a companys net income divided by its stockholders equity expressed as a percentage. Price-earnings ratio on common stock and f dividend yield on common stock. Interest and net profit before tax rs 400000.

For example if the net income is 1 million and stockholders equity is 10 million the rate earned on stockholders equity is equal to 100 multiplied by 1 million divided by 10 million or 10 percent. For eg if the net profit is 1 million and the shareholders equity is 10 million the shareholders equity amount is equivalent to 100 times 1 million divided by 10 million or. In this case preferred dividends are not included in the calculation because these profits are not available to common stockholders.

Compared to the industry average of 224 the company ABC is a safe bet for investing. Assume net income of 50000 preferred dividends of 10000 and. As functions of Owners Shareholders or Stockholder are liable for sharing all the profit and losses of the company.

Dictionary of Accounting Terms. Equity share of rs 100 each rs 200000. From the following data determine for the current year the a rate earned on total assets b.

Return on common stockholders equity net income less preferred dividends divided by average common stockholders equity. Rate earned on common stockholders equity d. Rate earned on total assets A measure of the profitability of assets without regard to the equity of creditors and stockholders in the assets.

Shareholders ratio ratio investopedia. Priceearnings ratio Decide a whether Dangerfields ability to pay debts and to sell inventory improved or deteriorated during 2018 and b whether the investment attractiveness of its common stock appears to have increased or decreased. Rate earned on stockholders equity A measure of profitability computed by dividing net income by total stockholders equity.

Anastasia finds out that for each dollar invested the company ABC returns 292 of its net income to the common stockholders. Earnings per share on common stock e. First the excess is actually part of what they paid in and is part of their.

Ratio indicating the earnings on the common stockholders investment. Earnings per share of common stock i. ROCE Net income preferred dividends average common equity x 100 850000 200000 2225000 x 100 292.

The return on equity ratio formula is calculated by dividing net income by shareholders equity. Round your answers to one tenth of a percent XX 2016. Dividing 63 billion income by 93 billion equity yields a rate of return on equity of 68.

Hence Stockholders Equity in common language is Capital Invested by the Owners in the Company. January 5 2020 at 402 pm. Redirected from Rate Earned on Common Stockholders Equity Return on Common Equity A publicly-traded companys earnings less dividends on preferred shares divided by the amount of money invested in common stock expressed as a percentage.

Stockholders Equity Rate Of Return On Common Stock Equity C S Shareholder Profitability Youtube

Stockholders Equity Balance Sheet Guide Examples Calculation

Comments

Post a Comment